As history shows, a new financial year usually brings new opportunities in super and the commencement of the 2021/22 financial year is no different. From 1 July 2021, indexation of the contribution caps, Transfer Balance Cap (TBC) and Total Super Balance (TSB) takes place. Then there’s the announced continuation of the 50% minimum pension requirement, which has been in place for the previous two financial years.

Indexation of contributions

The concessional and non-concessional contributions caps have been increased from 1 July 2021 in line with the indexation of the TBC and TSB. For concessional contributions, the standard amount has been increased to $27,500, and for non-concessional contributions the standard amount has been indexed to $110,000.

Concessional contributions

The increase in concessional contributions means that contributions made by an employer, salary sacrifice contributions and personal deductible contributions, from 1 July 2021, will have a standard cap of $27,500 before tax penalties will apply. The amount that can be contributed is not restricted by a person’s super balance and if the total amount in super on 30 June 2021 is less than $500,000, they may be able to bring forward any concessional contributions that can still be claimed under the caps since 1 July 2018.

For individuals who is salary sacrificing to superannuation, it may be worthwhile to make any adjustments to the amount being salary sacrificed so that the increase of concessional contributions to $27,500 can be made.

There is also an increase in the amount an employer is required to contribute for superannuation guarantee purposes from 1 July 2021. The increase is from 9.5% to 10% of an employee’s ordinary time earnings.

Non-concessional contributions

The non-concessional contributions cap has been increased to $110,000 from 1 July 2021. This means that anyone with a TSB of less than $1.7 million from that time can make non-concessional contributions of up to $110,000 if they are aged under 67 years. If they are between 67 and under 75 years old, non-concessional contributions can be made providing, they meet the work test of 40 hours in 30 consecutive days.

For anyone under 65 years old it is possible to access the bring forward rule of up to two years’ concessional contributions from the year in which a person makes more than the standard amount of $110,000.

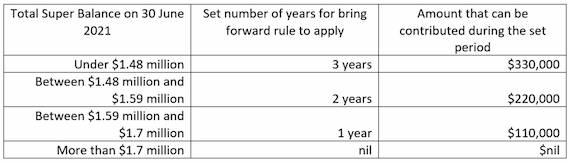

The total non-concessional contribution that can be accessed under the bring forward rule depends on a person’s TSB on 30 June in the previous year as shown in the following table:

As an example, if a person has a total super balance of $1.3 million on 30 June 2021 and makes a non-concessional contribution of greater than $110,000 during the 2021/22 financial year, they will trigger the bring forward rule and can then contribute up to $330,000 at any time during the 2021/22, 2022/23 or 2023/24 financial years.

A word of warning for individuals who has triggered the bring forward rules in the 2019/20 or 2020/21 financial years. Once the bring forward rule has been triggered in a year prior to indexation, there is no access to the increase until the set period has ceased. For example, if a person triggered the bring forward rule in the 2020/21 financial year and they were entitled to access the three-year rule, they would only be entitled to three times the standard non-concessional contribution for the year in which the trigger occurred, which is $300,000 ($100,000 x 3).

Pensions

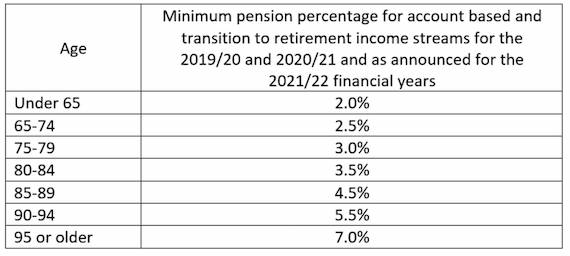

On 29 May, the government announced that the 50% reduction in pensions would continue for the 2021/22 financial year.

Here are the reduced percentages:

Don’t forget that the minimum pensions are based on the opening balance of the pension on 1 July in the financial year, or pro-rated on a daily basis if it commences during the year. In many cases the exact amount of the balance may not be known on 1 July, but it is good to make a reasonable estimate to start drawing a regular amount which can be adjusted later in the year when more accurate figures become available.

Other things to consider

Apart from making contributions and adjusting pensions in superannuation, it may be a good time to review the fund’s investment strategy, any death benefit nominations and have a health check of the fund’s trust deed.

A review of the fund’s investment strategy should consider whether the fund’s investments are in line with the nominated asset allocation ranges or consider any new investment classes. This could include crypto currency or artworks and collectables.

When it comes to binding death benefit nominations, where there has been any change to a person’s circumstances an amendment could be considered. This could occur where a person’s dependants have changed or a loved one who is nominated has passed away. Also, a person may wish to change their nomination from a three-year lapsing nomination to a non-lapsing nomination, or to change the types of benefits payable to their dependants from lump sums to pensions or a combination.

Review of a trust deed always is a sticky issue but is essential if it is worn out. Making sure it is up to date is important so that current types of contributions can be accepted by the fund and current types of benefits can be paid.

Estate planning

Estate planning is not a set and forget strategy. Any estate plan should be regularly reviewed so that it meets a person’s wishes and any change in the family’s situation. Even where an individual is not impacted by indexation of the caps from 1 July 2021, a couple with a combined amount in super of more than $1.7 million could have an estate plan which may require a review. This may be due to the restricted amount that can be retained in super on the death of a partner.

Start the financial year the right way

Before we know it, this financial year will be a fading memory and the next year will be off and running. Why not make a new year’s financial resolution to get things in order as soon as possible so that contributions, pensions and the fund administration are in the best shape possible. Speak to us today on Phone: 07 3162 0092.

Reproduced with the permission of the AMP Capital. This article was originally published at https://www.ampcapital.com/au/en/insights-hub/articles/2021/june/planning-ahead-for-the-new-financial-year

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.